United States Automotive Turbocharger Market to Reach USD 6,671.0 Million by 2035, Driven by Fuel Efficiency Mandates

The United States Automotive Turbocharger Market is segmented by vehicle type, product, fuel, sales channel, actuator, and sub-region from 2025 to 2035.

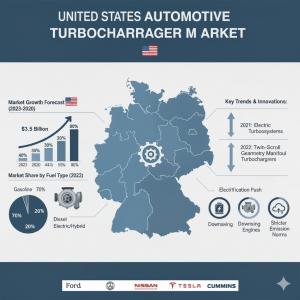

NEWARK, DE, UNITED STATES, November 12, 2025 /EINPresswire.com/ -- The United States Automotive Turbocharger Market is on course for a powerful decade of expansion, rising from USD 2,950.5 million in 2025 to USD 6,671.0 million by 2035, reflecting an 8.5% CAGR, according to the latest industry analysis by Future Market Insights. The market’s acceleration is being fueled by a convergence of regulatory, technological, and consumer-driven shifts toward cleaner, more efficient internal combustion engines (ICEs) and hybrid powertrains.

Fuel Efficiency and Emissions Drive Turbocharger Adoption

As U.S. automakers face tightening federal and state-level emissions regulations, including the Environmental Protection Agency’s (EPA) Tier 3 and LEV III standards and the Corporate Average Fuel Economy (CAFE) targets, turbocharging has emerged as a pivotal solution. Turbochargers enhance the air intake efficiency of engines, enabling smaller-displacement powertrains to deliver higher output while meeting stricter emission thresholds.

Passenger cars continue to dominate the domestic landscape, accounting for the largest share of turbocharger installations. Automakers including Ford, General Motors, and Stellantis have expanded turbocharged engine offerings across their sedan, SUV, and crossover portfolios. Models equipped with turbocharged gasoline direct injection (TGDI) systems now serve as the cornerstone of compliance strategies to meet evolving emission and performance expectations.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates -

https://www.futuremarketinsights.com/reports/sample/rep-gb-21932

Variable Geometry Turbochargers (VGT) Lead the Technology Race

Among product categories, Variable Geometry Turbochargers (VGTs) hold a commanding lead, owing to their capability to dynamically adjust vane angles and deliver optimal boost pressure across variable engine speeds. VGTs are now widely adopted in both gasoline and diesel applications, particularly in light-duty trucks, SUVs, and hybrid vehicles, where performance and emissions compliance converge.

Enhanced with electronic actuation, ceramic bearings, and heat-resistant alloys, next-generation VGTs are set to maintain leadership well into the next decade. Their adaptability makes them an essential component in hybrid and plug-in hybrid (PHEV) architectures — supporting smoother transitions between electric and combustion modes while optimizing fuel economy.

Regional Dynamics: From Green Innovation to Diesel Powerhouses

The U.S. turbocharger landscape is marked by pronounced regional differentiation:

West Coast (California, Oregon, Washington) — Acts as the epicenter of green mobility innovation. Stricter state-level emissions standards have spurred OEMs to integrate turbocharging within hybrid systems. R&D centers in California are experimenting with titanium aluminide turbine wheels and ceramic ball bearings to cut turbo lag and improve efficiency.

Midwest (Michigan, Ohio, Indiana) — The manufacturing heartland for turbo systems, hosting major OEMs, engine design firms, and tier-1 suppliers. The region leads in fleet remanufacturing and additive manufacturing (3D-printed) turbo components, advancing cost efficiency and product lifecycle management.

Southwest (Texas, Arizona, New Mexico) — A dominant diesel truck market, the region drives strong OEM and aftermarket demand for twin-turbo and high-duty VGT systems, especially in off-road and commercial fleets. Texas remains a hub for turbocharger assembly and distribution networks.

Northeast (New York, Massachusetts, Pennsylvania) — Focused on compact, fuel-efficient cars with turbocharged gasoline engines. Proximity to research facilities and universities supports innovation in corrosion-resistant materials designed for cold, salt-belt environments.

Southeast (Florida, Georgia, Carolinas) — A growth hotspot driven by regional auto assembly plants, logistics fleets, and a thriving used-car aftermarket. The motorsport culture in North Carolina fuels performance turbocharger demand among tuners and racing enthusiasts.

Challenges: Supply Chain and Electrification Pressures

Despite a strong outlook, U.S. turbocharger manufacturers continue to grapple with supply chain disruptions and dependence on Asian imports for critical components like actuators and sensors. Rising raw material costs for nickel, aluminum, and titanium further compress margins.

Electrification poses another structural challenge. While pure battery-electric vehicles (BEVs) continue to expand, the immediate growth lies in mild-hybrid and hybrid powertrains, where turbochargers remain central to achieving performance and emissions balance. OEMs are now investing heavily in 48V e-turbo systems to deliver instant torque and minimize turbo lag, aligning with hybrid propulsion strategies.

Opportunities: Aftermarket, Hydrogen Engines, and Smart Turbo Systems

The aftermarket and performance segment is experiencing a surge in demand for bolt-on turbo kits, intercooler upgrades, and retrofit solutions for aging fleets and enthusiast vehicles. With tuners and commercial operators seeking both performance and fuel efficiency gains, aftermarket suppliers are well-positioned to capture significant share.

Emerging frontiers also include turbochargers designed for hydrogen combustion engines and intelligent turbo systems with IoT-enabled diagnostics. These smart systems, capable of real-time data analysis and predictive maintenance, are expected to redefine fleet reliability standards and minimize downtime.

Checkout Now to Access Industry Insights:

https://www.futuremarketinsights.com/checkout/21932

Competitive Landscape: Global Leaders Deepen U.S. Footprint

The U.S. turbocharger industry is highly consolidated, with global leaders strengthening local production and partnerships.

Garrett Motion and BorgWarner Inc. collectively control over 40% of the market, emphasizing innovations in lightweight materials and AI-based control systems.

Cummins Inc. continues to dominate the heavy-duty segment through its Holset turbo line, recently expanding the HE200WG for light on-highway and off-highway applications.

IHI Corporation and Mitsubishi Heavy Industries maintain competitive positions in compact and mid-range vehicle segments, offering advanced efficiency-oriented designs.

In September 2024, BorgWarner unveiled its largest twin-turbo system for General Motors’ Chevrolet Corvette ZR1, delivering over 1,060 horsepower and marking a new milestone in performance engineering.

Future Outlook: Hybridization and AI-Driven Turbo Evolution

Between 2020 and 2024, turbocharging was a compliance-driven solution to emissions and fuel economy targets. From 2025 onward, it transitions into a smart, hybrid-integrated technology embedded within the next generation of ICE and hydrogen engines.

As the market evolves toward e-turbochargers, predictive diagnostics, and additive manufacturing, the United States is set to remain a key innovation and production hub. Increasing investment in domestic manufacturing and AI-powered design optimization will shape the competitive edge of American suppliers in the global turbocharging landscape.

Purchase Full Report for Detailed Insights

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.